Are you collecting your invoices effectively?

Apr 24, 2017

Measuring your efforts

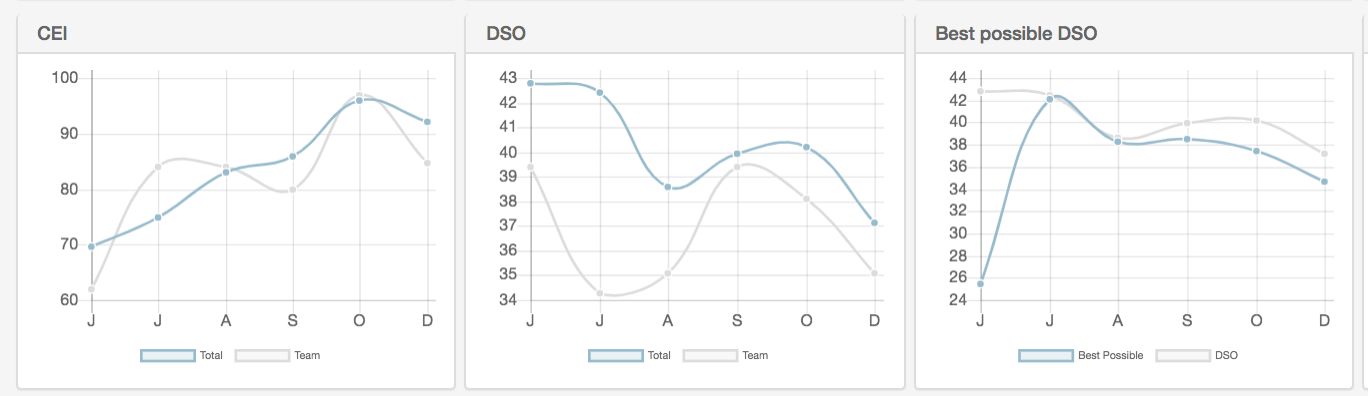

In an earlier DSO post I talked about calculating your DSO. The most well know way to benchmark your A/R is by using the Days Sales Outstanding (DSO) calculation. It’s a common, well understood indicator that is widely used. The fact that it is so common makes it easy to find DSO numbers for an industry or individual company, both locally and across the world. This enables you to benchmark against those DSO numbers and ask questions about your receivables. You can answer such questions as: How am I doing with my customer base compared to company X in my same industry? Are my terms in line with others in my industry? etc.. However, many credit professionals will tell you that they dislike DSO as an internal benchmarking metric and I will give you an example why.

The DSO problem

DSO is not the most accurate way to indicate if you are collecting effectively. DSO can be misleading as it has a key weaknesses, that is it fluctuates with revenue. Changes in sales inversely affect the DSO. If your overdue receivables balance stays the same an increase in sales for the month will lower your DSO. If you suddenly have a dip in sales your DSO will shoot up. DSO, while valuable for benchmarking, cannot alone give you a clear picture of the performance of your A/R. Three other measures of collections performance include ADD and CEI. These help complete the A/R picture and let you know if you are truly being effective in your efforts to get paid faster.

Collection Effectiveness Index

The Collection Effectiveness Index (CEI) is becoming increasing popular in the credit and collections world. CEI was developed by Dr. Venkat Srinivasan and the Credit Research Foundation Link. With the Credit Research Foundation collecting statistics, it is also possible to do the same industry benchmarking and comparisons that you might do with DSO. CEI is a percentage that expresses the effectiveness of collection efforts over time. The closer to 100 percent, the more effective the collection effort. CEI is ratio that measures the quality of collection efforts over time. It is essentially the percentage of receivables closed or paid in a given time period. While “Percent Current” has a implied limit of 100%, this is not the case for CEI.

CEI is a more appropriate measure of performance over time while DSO is for measuring performance at a single point in time. CEI makes comparison with other companies possible just as DSO does. CEI does not change if a company nets their receivables by removing items they deem disputed and therefore un-collectible.

CEI and DSO should move in opposite directions which makes sense. If your collections efforts increase your DSO should decrease. DSO and CEI can, under certain write off and revenue conditions again, track the same way and thus we have another exception.

This leads us to 2 more performance indicators that are important metrics.

Best Possible DSO

The Best Possible DSO indicates the “best” possible days you can collect on your invoices. This measure uses the “current receivables” instead of the total receivables balance. Current receivables is the amount of your A/R that is not past due. The closer your DSO is to the Best Possible DSO, the closer you are to collecting as fast as possible. You should not expect that you ever hit this number as is almost never possible. Assuming you give 30 days term (30 days to pay), if you can get within a 3-5 days of this you are doing really well.

Best Possible DSO = (Current Receivables x Number of Days in Period ) / Credit Sales for Period

Average Days Delinquent (ADD)

Average Days Delinquent (ADD), which is sometimes called Delinquent DSO, calculates the average time from the due date to the paid date. In other words its the average days invoices are past due. It provides a snapshot to evaluate the overall company’s collection performance but it’s also useful at the customer, customer type, collector segment, etc.. This not the same as Average Days To Pay which is based on the historical information of the actual closed invoice while ADD is based on a snapshot in time (Thanks Terry.)

Average Days Delinquent (ADD) = Standard DSO - Best Possible DSO

Summary

In light of the fact that DSO alone does not accurately measure performance in credit and collection, we can now arm ourselves with 2 more indicators for accurately measuring performance; CEI and ADD. When CEI and DSO track the same way because of revenue fluctuation or changed in terms of sale ADD comes to the rescue and takes both into account.

While DSO has its faults, its is a must have indicator because it is so well understood and enjoys wide acceptance amongst financial professional. When combined with the ADD and CEI you can truly get a complete performance picture of your accounts receivable.